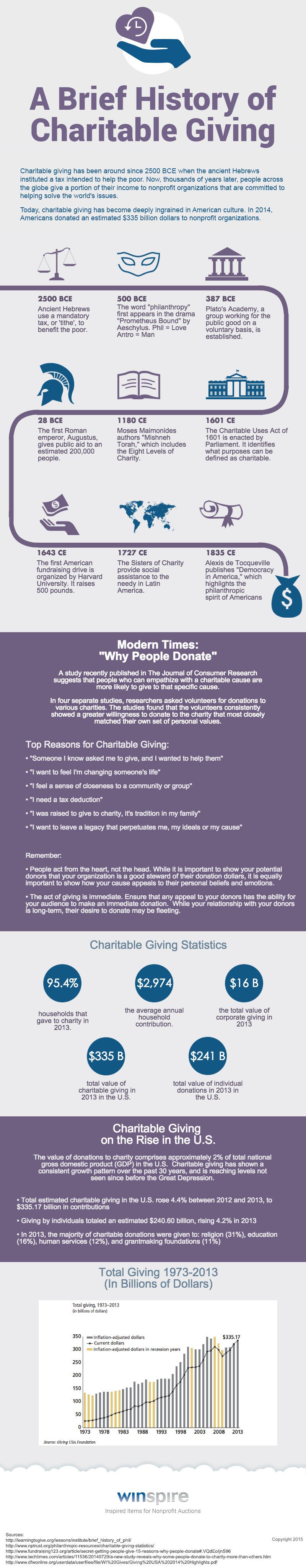

Charity has been part of human culture for thousands of years. There are numerous instances of charitable acts in ancient civilizations dating back as far as 2500 BCE (or 4,500 years ago), which is around the time the Egyptians were building the pyramids.

More recently over the last 30 years or so, donations to charitable organizations have increased consistently year-over-year, far outpacing the rate of inflation. Today, charitable giving is a core value of western culture with over 95% of U.S. households donating to charity in 2013!

Where did all of this generosity come from? In the following infographic we break down some of the historical trends to show the progress of charitable giving.

Share this Infographic On Your Site!